Irs payroll withholding calculator

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. All Services Backed by Tax Guarantee.

Calculation Of Federal Employment Taxes Payroll Services

2022 Federal income tax withholding calculation.

. From the IRS. The amount you earn. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator.

IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax. Then look at your last paychecks tax withholding amount eg. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The maximum an employee will pay in 2022 is 911400.

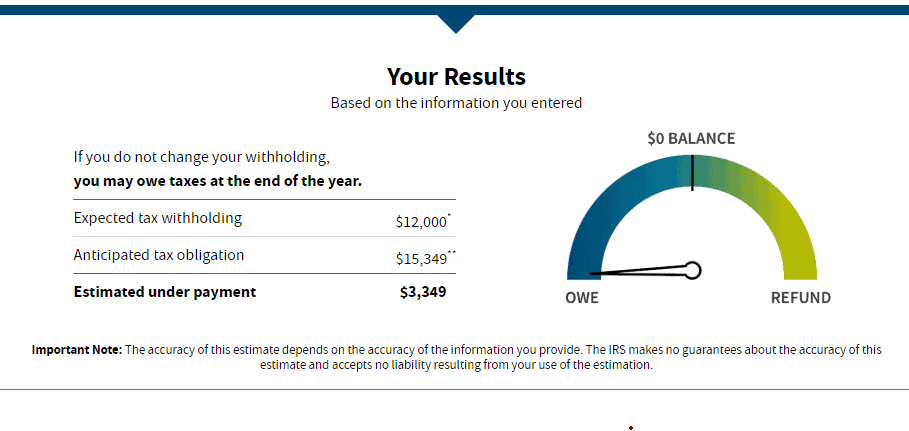

The Withholding Calculator enables taxpayers to get their tax withholding right by making sure these and other tax changes are built into their take-home pay. Change Your Withholding. For example if an employee earns 1500.

If you are an employee the Withholding Calculator can help you determine whether you need to give your employer a new Form W-4 Employees Withholding. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. The information you give your employer on Form. There are two main methods small businesses can use to calculate federal withholding tax.

Subtract 12900 for Married otherwise. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. That result is the tax withholding amount.

The amount of income tax your employer withholds from your regular pay depends on two things. Go to the main. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

The calculator helps you determine the. Here are step-by-step instructions for using the calculator. IRS tax forms.

Complete a new Form W-4 Employees. 250 minus 200 50. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How to calculate annual income. IR-2019-111 IRS reminds taxpayers to adjust tax withholding to pay the right tax amount. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes.

Before beginning taxpayers should have a copy of their most recent pay stub and tax return. Computes federal and state tax withholding for. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The wage bracket method and the percentage method. To change your tax withholding use the results from the Withholding Estimator to determine if you should. 250 and subtract the refund adjust amount from that.

2

Irs Witholding Calculator

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Irs Improves Online Tax Withholding Calculator

Tax Withholding Estimator Shortcomings Virginia Cpa

2

Calculation Of Federal Employment Taxes Payroll Services

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Irs Tax Withholding Estimator Irs Com

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

How To Calculate Payroll Taxes For Employees Startuplift

Irs Launches New Tax Withholding Estimator

Tax Withholding For Pensions And Social Security Sensible Money